Endologix Closes Offering of $125 Million of Senior Convertible Notes

Represented Endologix, Inc. (Nasdaq: ELGX) in its registered underwritten offering of $125 million of senior convertible notes. Endologix will use approximately $56 million of the net proceeds from the offering to repay certain outstanding indebtedness of TriVascular Technologies, Inc. (Nasdaq: TRIV) upon the closing of the company’s acquisition of TriVascular. Endologix will use the remainder of the net proceeds to finance the commercialization of its products, for working capital and other general corporate purposes.

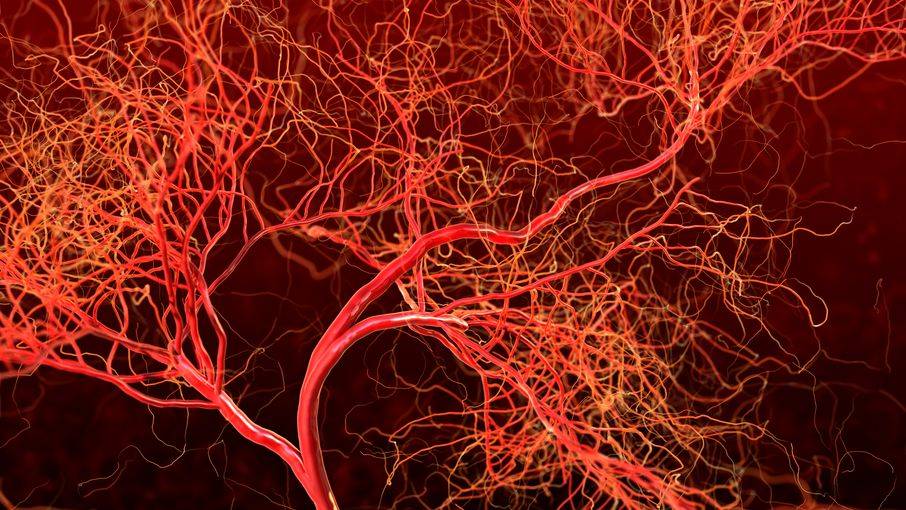

Endologix develops and manufactures minimally invasive treatments for aortic disorders, with a focus on endovascular stent grafts for the treatment of abdominal aortic aneurysms.